From 12 November 2016, existing unfair contract term protections for consumers will be extended to standard form small business contracts due to amendments to the Competition and Consumer Act 2010 (Cth) (Act).

Businesses who either contract with small businesses, or who are small businesses should review their contracts for terms which may be unfair, as these terms will not be legally binding if a Court ever determined that they are unfair within the meaning of the Act.

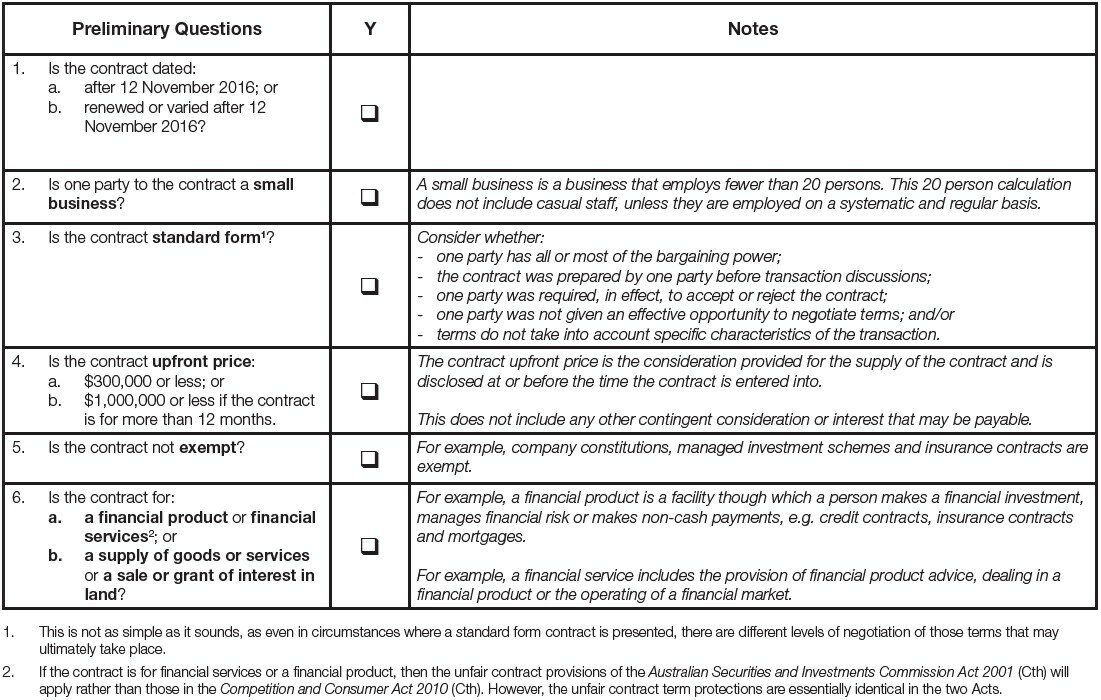

To assist, DW Fox Tucker has developed a basic checklist to determine whether you may be affected:

If you answered yes to each question, you should consider whether the contract contains terms which are deemed unfair. A term is unfair if:

- it would cause a significant imbalance in the parties’ rights and obligations arising under the contract; and

- it is not reasonably necessary to protect the legitimate interests of the party who would be advantaged by the term (Note: A term is presumed not to be reasonably necessary unless that party proves otherwise); and

- it would cause detriment (financial or otherwise) to a party if it were to be applied or relied upon.

Further, in determining whether a contract is unfair, you must take into account:

- the contract as a whole; and

- the extent to which the term is transparent (Note: a term is transparent if the term is in reasonably plain language, legible, presented clearly & readily available to any party affected by the term).

Ultimately whether a term is unfair requires legal expertise and judgment, as you must consider the contract as a whole, and remember that all contracts are entered into under different contexts. It may involve the weighing up of competing issues. Therefore we strongly recommend that legal advice be sought if there are any concerns as to whether a term of the contract may be unfair. However, some examples of terms which may be deemed unfair, as provided by the Australian Competition and Consumer Commission include:

1. A right to unilaterally vary the contract

A term of the contract provides the right for the company to change its prices or services at any time without prior notice to the small business. The small business does not have the right to terminate the contract, even if, for example, the company significantly increases its prices or services.

2. Automatic rollovers

Despite a 12 month term of the contract, a term in the contract has the effect of automatically renewing for a further 12 months unless the small business gives written notice that it does not wish to renew the contract before the initial term expires. Under the contract, the small business must pay a significant fee if it wishes to terminate the contract early.

3. Rights to terminate without cause plus damages

The contract provides that the supplier may terminate the contract any time by giving the small business 30 days’ notice. Another term of the agreement provides that, if the agreement is terminated, the small business must pay the supplier damages equal to the service fees for the remaining period of the contract.

4. Limited liability

A term of the contract states that the company accepts no liability for any loss, including loss arising as a result of the company’s negligence.

5. Wide indemnities

The contract contains a term that requires the small business to indemnify the other business against all loss and damage, including loss or damage caused by the other business.

All unfair terms will be void and will not be legally binding. The contract can, however, continue to bind the parties if it can operate without the term.

We encourage any businesses who either contract with small businesses, or who are small businesses to review their contractual arrangements leading up to 12 November 2016 and where necessary seek comprehensive legal advice.

To view our previous article which details the changes, please see http://www.dwfoxtucker.com.au/2016/02/1233/ or contact us for further information.